Leadership

Exploring Financial Officer Turnover in Europe

As European organizations navigate tumultuous macroeconomic trends, CFO retirements hit a four-year high, and turnover rates continue to increase, experienced financial leaders are few and far between. This poses significant risk to organizations looking to retain their CFOs in an increasingly competitive market.

As per our Global CFO Turnover Index, Russell Reynolds Associates analyzed CFOs of European organizations from 2020 to end of September 2023 (N=660) to summarize the latest turnover trends and gain insight into an increasingly competitive market where 57% percent have turned over since 2020. We found that:

- CFO turnover continues to increase across the board, with a four-year high in the FTSE 350, DAX and the Euronext 100

- The majority of newly appointed CFOs (61%) are in the role for the first time

- Women CFOs are coming from outside the organization, as internal talent is scarce

- CFO executive retirement has increased over the past four years, jumping 15 percentage points since 2022

The revolving CFO door: CFO turnover continues to increase across the board

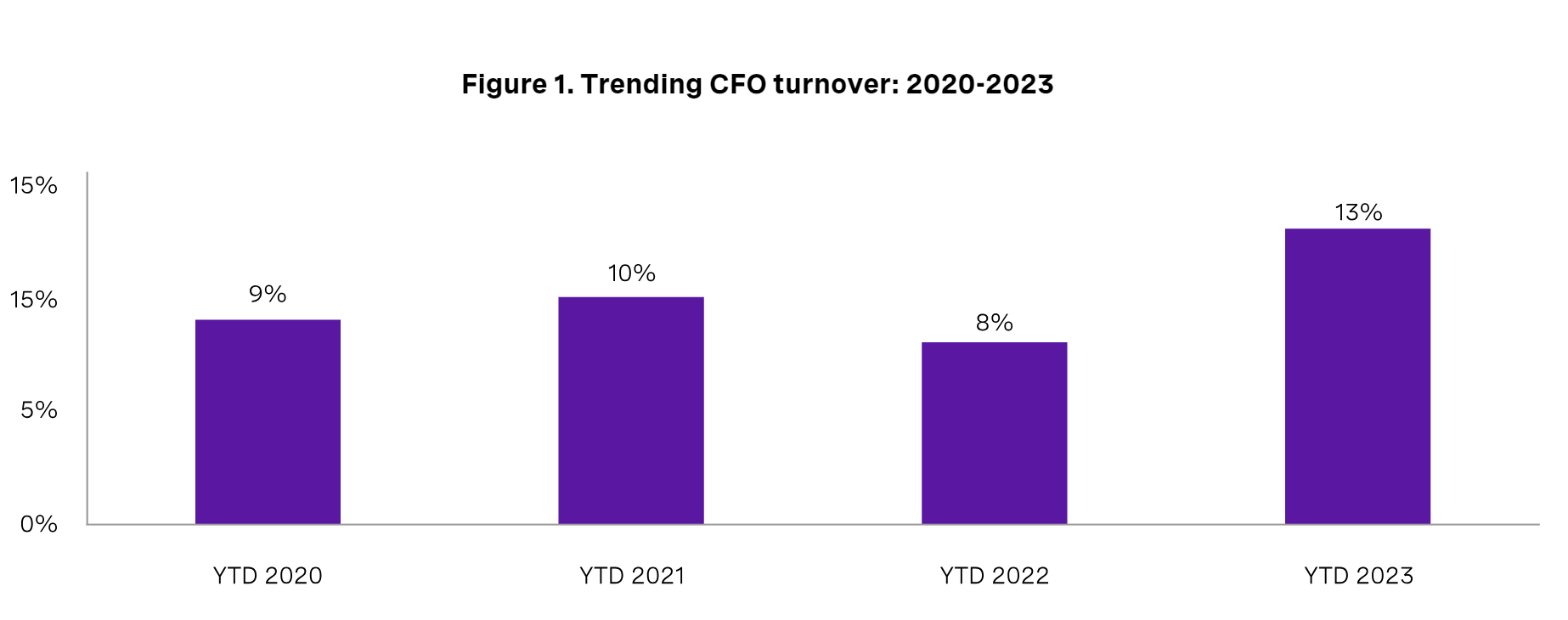

As of September 2023, European CFO turnover hit 13%, reaching a four-year high (Figure 1.) Recent high levels of CFO turnover suggest that this trend may become the norm, as increasing executive retirement rates, macroeconomic trends, and the fight for financial officer gender diversity are all contributing to these increases. This continuous churn creates new opportunities for next-generation finance talent, and is likely why the majority of newly appointed CFOs are in the role for the first time (we’ll explore this further in the next section).

The FTSE 350 & DAX 40 have been particularly active, with YTD CFO turnover reaching a four-year high of 13% and 23% respectively, while the Nordic regions have seen a significant decrease in the same period of time . The increase in turnover can be partly explained by unprecedented executive retirement rates for CFOs across Europe, coupled with an increased demand for experienced CFOs.

The majority of newly appointed CFOs are in the role for the first time

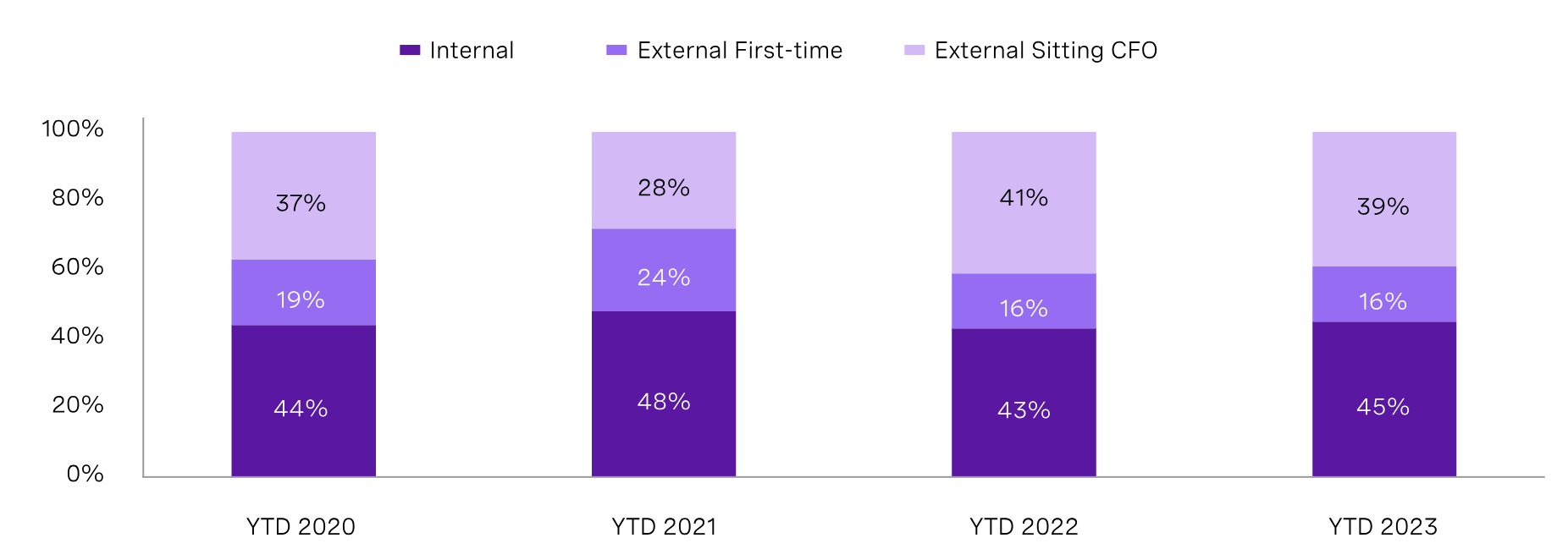

There continues to be more first time CFOs in the European market (61%) likely due to the record levels of CFOs retiring in 2023 and CFO succession plans coming to fruition. However, organizations that look externally for their next CFO are opting for proven talent (Figure 3.), likely wanting the stability of someone who has held the top job as we continue navigating economic uncertainty.

Women CFOs are coming from outside the organization, as internal talent is scarce

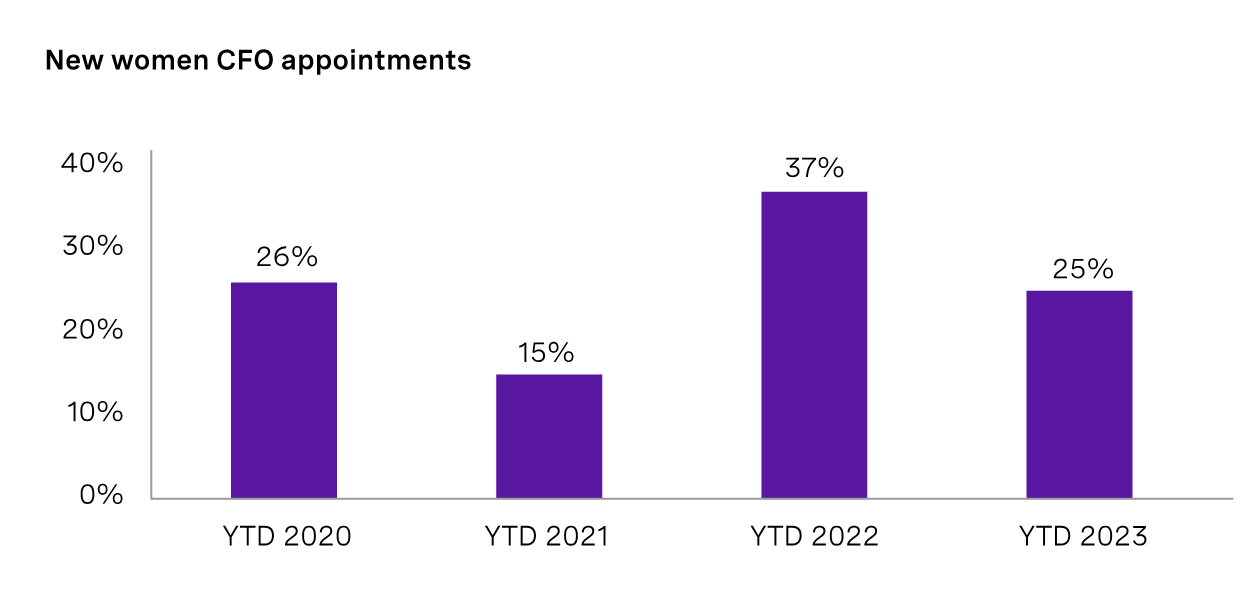

More women have been appointed to the top financial job than ever before, as women now hold 19% of CFO roles in the European indices we analyzed. While these improvements are encouraging, we’re still far from parity. And while 25% of 2023 CFO appointments were women, this has actually decreased 12 percentage points since last year.

Organizations without a gender-diverse bench are looking externally for more talent, typically recruiting experienced women CFOs. In fact, in 2023, 50% of appointed women CFO appointments were sitting CFOs prior (Figure 5a), versus 22% of male CFOs. These external hires indicate that internal financial officers' pipelines—while improving at lower levels—still lack gender diversity at the top.

CFO executive retirement has increased over the past four years, jumping 15 percentage points since 2022

Executive retirement rates reached a four-year high, increasing from 46% in 2022 to 61% of CFO departures in 2023. On average, CFOs are retiring at age 56. CFOs approaching retirement may not seek another CFO role due to factors like burnout, financial security, or deciding that retirement seems the more attractive option. Instead, many are leveraging their finance expertise in various board roles, especially in the UK where there are more opportunities and demand for CFOs to transition into chair positions (20% of current FTSE 350 chairs have CFO experience).

As many CFOs retire and demand for experienced CFO talent continues to increase, there are ample opportunities for financial officers. Of the 64% of CFOs who made external moves, 100% have opted for a CFO role. Perhaps unsurprisingly, those who made internal moves all opted for broader non-finance leadership roles, like CEO or general manager (Figures 7 and 8). We have also seen a 42% increase in transitioning CFOs taking on a new CFO role, from 15 in 2022 to 21 in YTD 2023. With the current economic and political headwinds organizations are facing in Europe, organizations are looking for seasoned CFOs to help navigate.